Maximize your potential

with options

Ultra-low commissions | Diverse portfolio strategies | Margin discounts

What is an option?

An option is a financial contract that provides the holder with the right to buy or sell a specific quantity of a particular asset, such as stocks, commodities, currencies, or indices, at a predetermined price, known as the strike price, within a specified period, known as the expiration date.

Option holders can choose to exercise or forgo this right within the stipulated time, while the option seller is obligated to fulfill the terms of the contract if exercised.

Why trade options?

Flexibility

Investors can purchase both call options (predicting that the underlying asset's price will rise) and put options (predicting that the underlying asset's price will fall). This dual nature allows investors to flexibly respond to different market trends.

Leverage

Option contracts have varying degrees of leverage that will enable investors to control larger positions with relatively less capital. This leverage can amplify potential profits but also comes with higher risk for losses.

Controlled Risk

The maximum potential loss is limited to the premium paid for the option contact. This means that the risk associated with buying options is known and finite.

Risk Hedging

Options can be used to hedge against potential losses in stocks or other asset portfolios. This allows investors to more effectively manage the volatility of their investments.

Enjoy seamless options trading experience with Tiger Trade

Free real-time market data

Gain access to L1 real-time quotes for US stock options and L2 depth data for Hong Kong stock options.

Comprehensive suite of tools & rankings

We provide tools such as Options Screener, Options Statistics, Top Options Ranking, and Bulk Order, to enhance your trading strategies.

Multi-leg strategy

We support Vertical, Straddle, Strangle, Calendar Spread, and Custom Strategy, catering to diverse market conditions.

Advanced order types

We offer Conditional Orders, Attached Orders, and OCA Bracket Orders to enhance your strategic flexibility.

Grow with the community

Elevate your options trading expertise by tapping into the knowledge of the community, where investors exchange insights and investment ideas.

Trade combination options like a pro

Tiger Brokers offers options combination trading, which comes with the following benefits:

Risk Management

Utilise composite orders to ensure simultaneous execution, thereby helping to hedge effectively and mitigate risk for your portfolio.

*Details on margin discounts can be found in the FAQ section.

Margin Discounts

Due to the typically lower risk profile associated with combination options, Tiger Brokers can offer specific margin discounts* for your trading strategies.

High Customisation

Diverse strategic options to empowering investors to tailor their portfolios to match the market outlook, investment objectives, and individual preferences.

*Details on margin discounts can be found in the FAQ section.

Practice options trading with a demo account

New to option trading?

Not to worry! Our $100K demo account is your playground to hone your options trading skills. Once you're ready, open & fund your account with as little as USD1 to get access to real-time market data.

*Availability of combination options in the demo account is subjected to the actual date of release.

Trade on PC

Bigger Screens. Better Trades

Smart Customization

Facilitates customization for combination options, enabling instant adjustments of strike prices and expiration dates in accordance with your preferences.

Enhanced Precision

Utilise professional analysis tools, including the Options price calculator, P&L analysis, and Greek Sensitivity analysis charts to assess your risk accurately.

Comprehensive Tools

Instant orders with one-click trading, screen options by Implied volatility (IV), and use our comprehensive set of charting tools for a user-friendly and seamless trading experience.

Transparent and competitive fees

US stock options

USD 0.65

USD 0.30

USD 0.35

USD 0.30

Hong Kong stock options

0.2%

HKD 15

Guide to trading options on Tiger Brokers

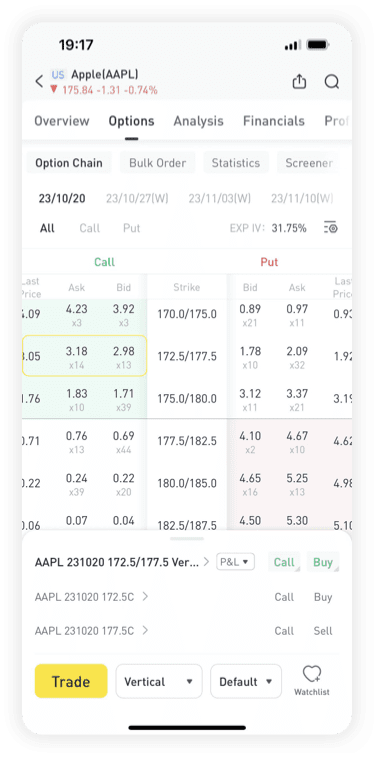

Go to any individual stock page and click on the 'Options' tab.

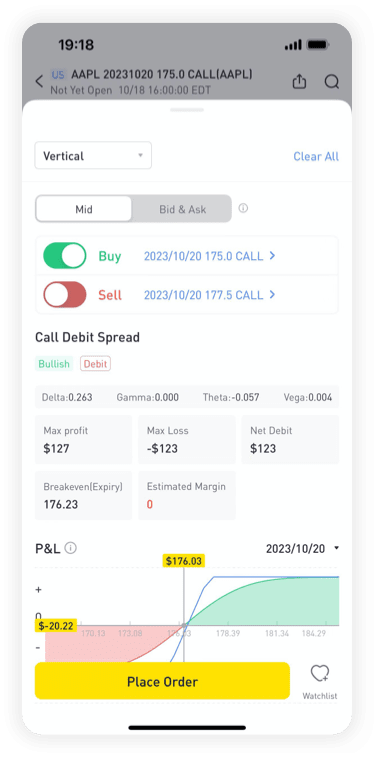

Tab any option to add predefined strategy, choose single or Multi-leg option strategy.

Click the contract to read additional details, and confirm call/put and buy/sell, then you can proceed to Buy/Sell. Input the required information and submit to place your order successfully.

FAQs

What types of US options trading does Tiger Trade support?

Does Tiger Trade support pre-market and after-hours trading for US options?

Does Tiger Trade support early exercise?

How does a stock split affect the price of options?

Which US stocks support options trading?

Which HK stocks support options trading?

What underlying assets are suitable for combination options?

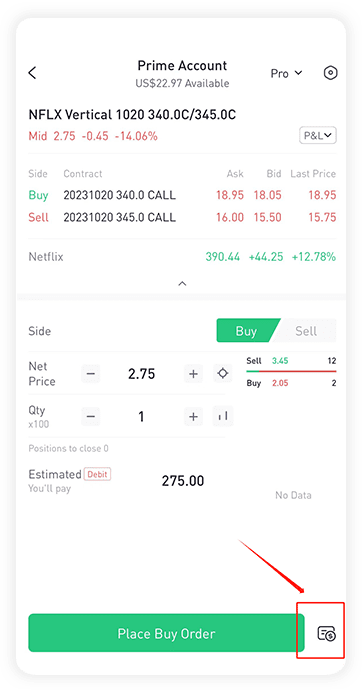

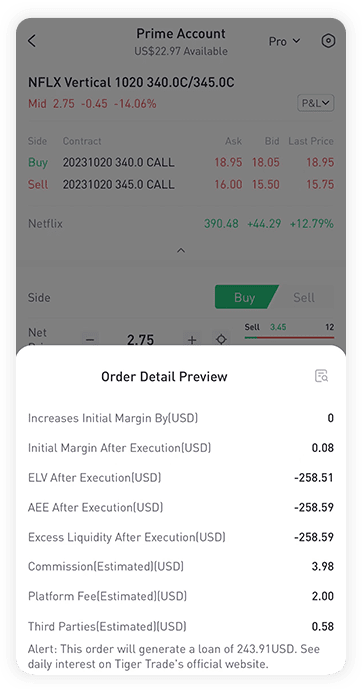

How can I check the margin required for an options trade?

Click on the icon located next to the buy/sell button on the order page to view the estimated margin, the commission cost and other important information.

How to place an combination option trade?

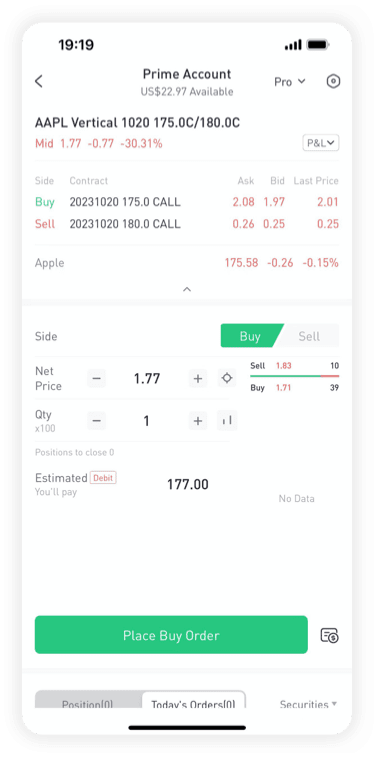

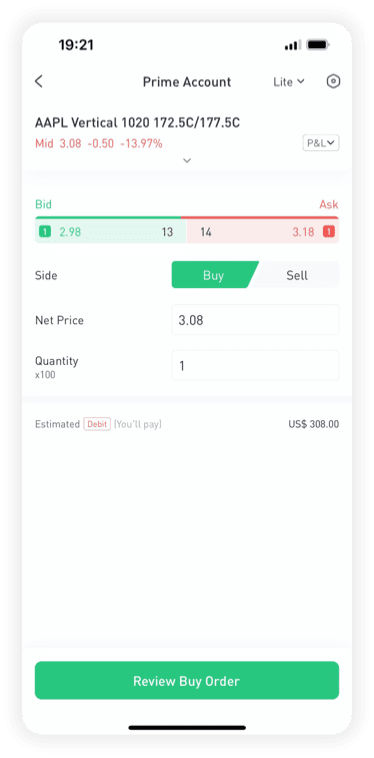

Simply click on the "Trade" button to access the order page (Support switching between Lite & Pro versions) The default net price is set as the mid-price, but you have the option to customise it based on your preferred price.

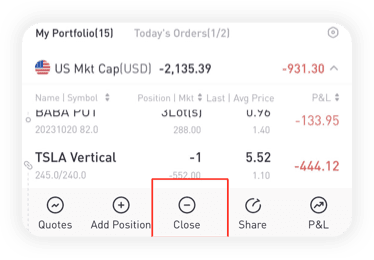

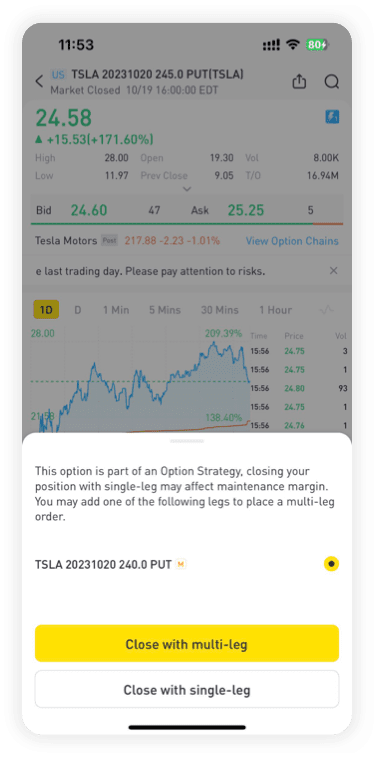

How to close an option combination?

Navigate to your portfolio, click 'Close' to close your combination order. In an event where users try to close a leg of an option that belongs to a specific combination order, Tiger Brokers will issue a reminder to avoid unintentional alteration in margin requirements.

Which options strategies are eligible for margin discounts?

- Covered Put : Investors simultaneously hold a certain quantity of short positions and sell an equivalent number of put options.

- Covered Call : Investors simultaneously hold a certain quantity of underlying assets (typically stocks) and an equivalent number of sell call options.

- Put Vertical Spread : Investors simultaneously buy a higher strike put option (long-term option) and sell a lower strike put option (near-term option).

- Call Vertical Spread : Investors simultaneously buy a lower strike call option (long-term option) and sell a higher strike call option (near-term option).

- Short Call and Put : Investors simultaneously sell a Short Call option and a Short Put option.

- Protective Put : This strategy combines buying stocks (or existing stocks) and purchasing an equivalent number of put options.

- Protective Call : This strategy typically consists of buying call options and holding an equivalent number of short positions.

- Put Calendar Spread : Buying and selling two put option contracts with different expiration dates but the same exercise price and underlying asset.

- Call Calendar Spread : Buying and selling two call option contracts with different expiration dates but the same exercise price and underlying asset.

What are the requirements to reduce the margins?

- If your new holdings can be combined with existing positions to form an option combination, the margin requirement for the combination may be reduced.

- Closing a portion of your combination option will render the order invalid and discontinue margin discounts, potentially increasing your account's risk. If your Excess Liquidity (EL) falls below zero, it may trigger a forced liquidation. Therefore, users are advised to ensure sufficient account funding before closing a combination option order.

- To minimize any margin increase upon closing, consider closing the options within the combination before the underlying stocks. Closing underlying stocks first may lead to the coexistence of options and stock positions in your account after the option combination becomes invalid. The combined margin requirement of both positions will be higher than the margin requirement of the option combination, leading to an increase in your account's margin.

- Please note that option combinations may currently not be applicable to certain positions due to corporate actions that result in changes in the underlying codes or contract multipliers.

- If the positions within the option combination are affected by such corporate actions, it may lead to the invalidation of the combination and consequently an increase in margin requirements. If your account's current Excess liquidity (EL) falls below zero, it may trigger a forced liquidation. Please ensure that you have sufficient funds in your account before closing positions within the option combination.

What are the fees for US option combinations on Tiger Trade?

The fee structure for option combination orders is consistent with that of single-leg orders, where each leg is billed as an individual contract (specific rates can be found on the official website). The total cost of the combination is calculated by aggregating the fees for all contracts involved.

For Example: A user purchases 2 vertical spreads in Apple, which consists of one call option and selling one call option within the same contract. The fees for 2 call options is US$0.65 per contract, which totals US$1.30 (US$0.65 * 2), however do note the minimum commission per order is US$1.99. Since there are 2 option contracts in 2 vertical spreads, the total commission is US$3.98.